Net non interest margin formula

Graph and download economic data for Banks Net Interest Margin for Nepal DDEI01NPA156NWDB from 2000 to 2020 about Nepal NIM Net banks depository. In the same year the bank paid 25 million in interest to its depositors.

/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

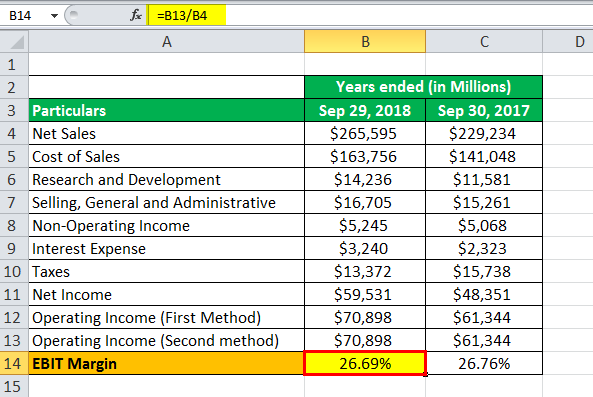

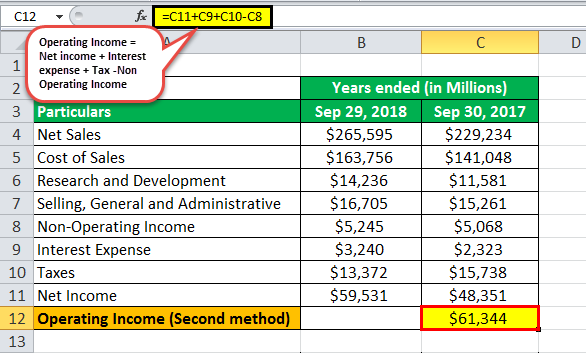

Ebit Vs Operating Income What S The Difference

For instance if a financial firm earns 500000 in a month.

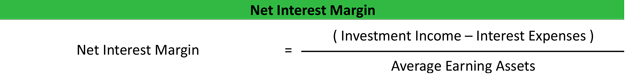

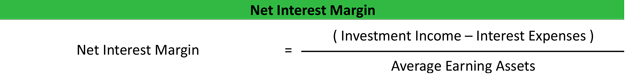

. Net Interest Margin Formula Interest Revenue Interest revenue is generated through interest payments the bank receives on outstanding loans. The banks net interest margin can be calculated using the following formula. 8 How can a bank increase its non-interest income.

C Net Interest Margin Formula Net Interest Margin Interest Income Interest from BBA 4142 at Southeast University Bangladesh. 4 What is Net Interest Margin. Net Interest Margin Investment Income.

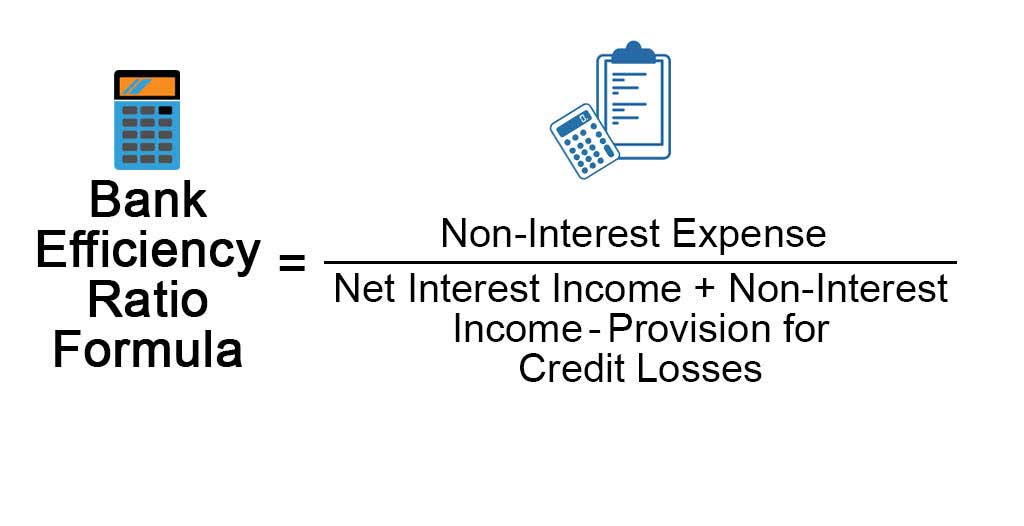

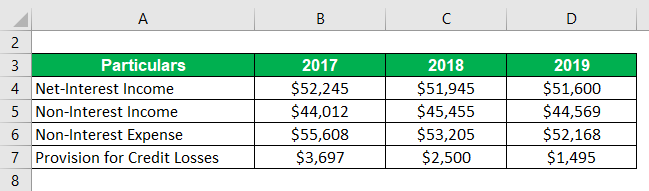

No-interest margin non-interest income - non-interest expense total earning assets. 9 What is the biggest non-interest expense for banks. 3 What is net income formula.

Using the aforementioned formula the banks net interest margin is 292. The net profit margin is determined by dividing net profit by total revenues in the following way. EBITDA Margin Net Income Interest.

In equation form. Net Profit Margin 45000 60000. However the net interest margin formula does not offer much in isolation.

Formula Net Profit Margin Net Income Revenue To adjust the value into percentage form youd need to multiply the value by 100. As stated earlier banks have additional non-interest income and incur operating expenses. Net non interest margin formula Senin 12 September 2022 1-Net Noninterest Margin 2-Efficiency Ratio 3-Earnings coverage ratio 4-EB Earnings Base Ratio.

Net profit margin is the ratio of net profits to revenues for a company or business segment. A Net non interest Margin Net non interest Margin Non-Interest Income - Non-Interest ExpensesTotal Assets Net non interest Margin 50 - 1002200 -227 b net oper. The net interest margin formula is calculated by dividing the difference of investment income and interest expenses by the average earning assets.

This means its investment returns total 45000 and its interest expenses are 10000. The net profit margin formula. Net interest margin 55.

The net interest margin is usually measured by taking a banks investment income minus its interest expenses and dividing it by its average earning assets. It is made up of credit. Here we discuss calculating EBITDA Margin with examples and also provide a calculator with an excel template.

Suppose a company has a net income of 45000. Guide to EBITDA Margin Formula. Net profit margin net profit total revenues.

The net margin formula is as follows.

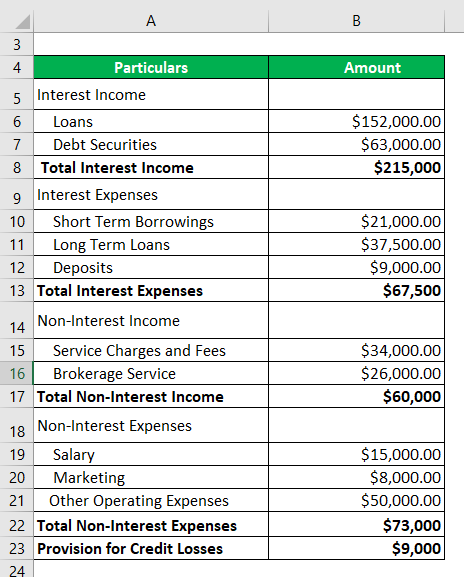

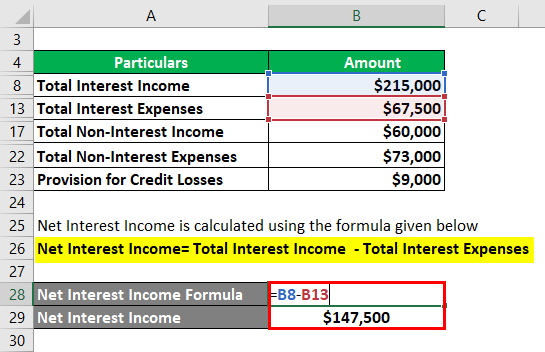

Net Interest Income Financial Edge

Net Interest Income Nii Formula And Calculator

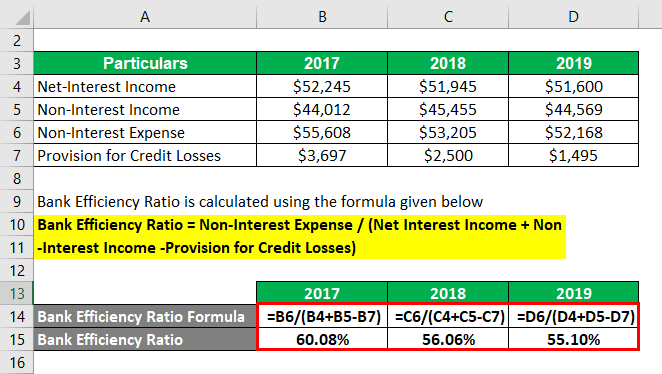

Bank Efficiency Ratio Formula Examples With Excel Template

Net Interest Income Nii Formula And Calculator

Ebit Margin Formula Excel Examples How To Calculate Ebit Margin

Non Interest Income Of Banks Definition Examples And List

Net Interest Income Overview And How To Calculate It

Net Interest Margin Nim Formula Example Calculation Analysis

Bank Efficiency Ratio Formula Examples With Excel Template

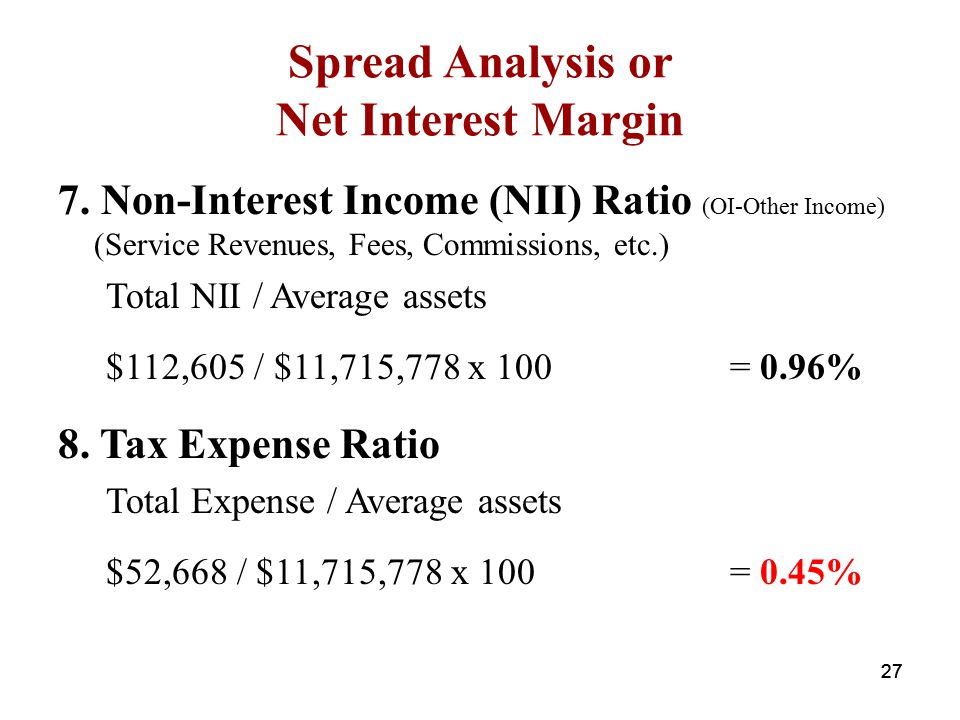

Turning Bank Financial Statements Into Useful Ratios Trends Ppt Video Online Download

Profit Margin Formula And Ratio Calculator

Bank Efficiency Ratio Formula Examples With Excel Template

Bank Efficiency Ratio Formula Examples With Excel Template

Net Profit Margin Formula And Ratio Calculator

Ebit Margin Formula Excel Examples How To Calculate Ebit Margin

Bank Efficiency Ratio Formula Examples With Excel Template

Net Profit Margin Formula And Ratio Calculator